Project Overview

This data analysis project examined factors influencing housing prices in Boston to create predictive models for future pricing. We analyzed various neighborhood characteristics to identify significant patterns that impact property values.

Key Questions

How do crime rates relate to housing prices in Boston?

What are the overall characteristics of houses ranging from cheap to expensive?

Is multicollinearity present in coefficient estimates from linear regression models when analyzing housing prices?

Dataset

Our analysis used the Boston housing dataset from the MASS package in R, which contains:

Data from 506 Boston suburban neighborhoods

14 variables including crime rates, number of rooms, accessibility to highways, etc.

Data compiled in 1978, providing historical perspective on housing market factors

Key variables analyzed included crime rate per capita, nitrogen oxide concentration, average number of rooms, distance to employment centers, highway accessibility, property tax rate, Charles River boundary status, and proportion of lower status population.

Methodology

We employed a comprehensive statistical approach using R:

Data wrangling to clean and transform the dataset for optimal analysis

Exploratory data analysis with visualization to understand relationships

Linear regression modeling with backward selection to identify significant variables

Variance Inflation Factor (VIF) analysis to detect multicollinearity

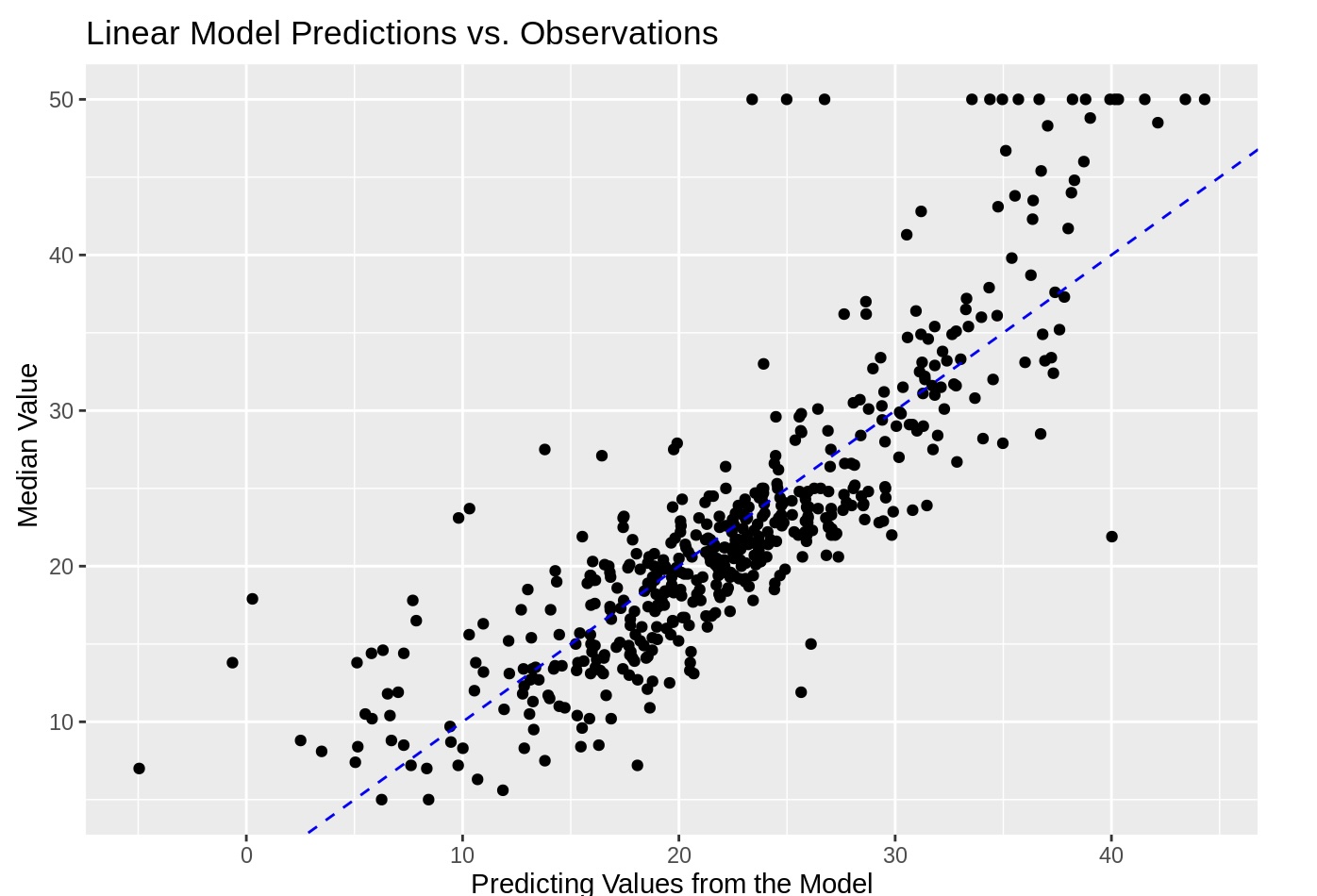

Comparison of predicted values versus actual observations to validate model accuracy

Tools Used

Our analysis was performed in R using packages including dplyr, tidyverse, tidymodels, skimr, ggcorrplot, GGally, and car for statistical testing.

The Model

Our final predictive model was derived using backward selection to include only statistically significant variables:

median housing prices = 14.2 - (0.102 * crimerate) - (9.61 * nitrogen) + (4.28 * rooms) - (1.56 * distance) + (0.227 * highway_access) - (0.016 * property_tax) + (0.009 * black_proportion) + (3.21 * river_bound) - (55.3 * lower_status) + (7.98 * residential_lots)

Model Performance

Model Accuracy

R-squared value of 0.712

Explains 71.2% of variance in housing prices

Age of houses and proportion of non-retail businesses were not significant

Variable Significance

Crime rate alone explained only 14.9% of variance

Number of rooms had strong positive correlation

Lower status population proportion had strongest negative effect

Key Findings

Crime Rate Impact

Crime demonstrated a clear negative relationship with housing prices. While crime rate alone accounts for only 14.9% of the variance, each percent increase in crime rate was associated with a housing price decrease of approximately $415.

Housing Characteristics by Price

High-Value Properties

Low crime rates

Low nitrogen oxide concentration

More rooms on average

Close to employment centers

Better highway access

Lower property tax

Often riverbound

Low-Value Properties

High crime rates

High nitrogen concentration

Fewer rooms on average

Far from employment centers

Limited highway access

Higher property tax

Rarely riverbound

Multicollinearity Results

VIF analysis revealed moderate to high multicollinearity among several variables:

Tax rate had highest VIF at 8.96

Highway access had VIF of 7.22

Nitrogen oxide concentration and distance to employment centers had VIF values around 4

These findings suggest caution when interpreting these variables, as they are not fully independent predictors

Conclusions

Our analysis successfully identified key factors affecting Boston housing prices, with several important takeaways:

Environmental and socioeconomic factors have significant influences on housing prices

Our model explains 71.2% of variance in housing prices using 11 variables

Property characteristics (rooms, location) and neighborhood qualities (crime, status) are both crucial factors

Proximity to amenities significantly increases property values

The remaining 28.8% unexplained variance suggests additional factors not captured in the dataset are also important

These findings provide valuable insights for real estate professionals, urban planners, and policymakers interested in understanding housing market dynamics in Boston and similar urban areas.

This project was completed in collaboration with Chaska Kentish and Charles Ye.